I recently entered a NYC Housing Lottery which turned out to be only slightly less stressful than that described in Shirley Jackson’s short story of the same name. Is at least one person in your household a US citizen? If not, does at least one person have legal immigration status (e.g. The NYC Housing Lottery: All you need is a low enough income and a dream.The lists indicate whether the development is a rental or cooperative. Affordable housing as defined by the Department of Housing Preservation and Development (HPD) simply means a monthly rent costing no more than 30 of the individual’s income. The remaining 80 percent are rented at market rates, but are subject to rent stabilization.To be eligible for public housing, you should be able to answer yes to these questions. Following are lists, by county, of HCR supervised Middle Income Housing Developments for Families and Senior Citizens constructed under New York States limited profit and limited dividend housing programs. Fortunately the process for all the various lotteries now takes place through one platform, known as NYC Housing Connect, making it easier to apply.

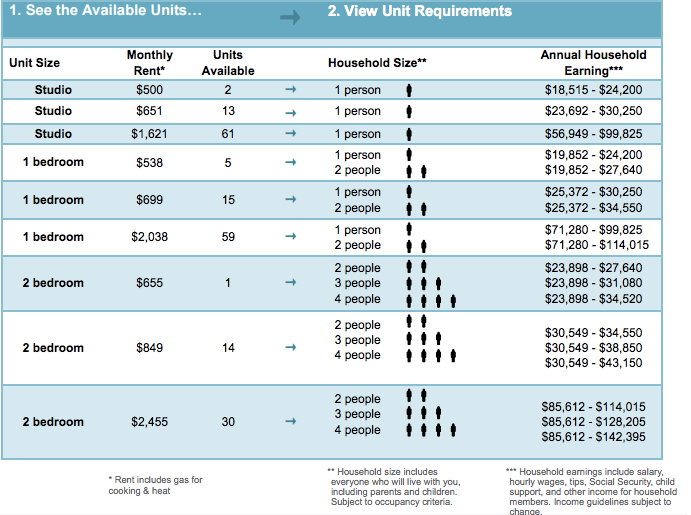

As of December 31, 2015, 68 developments, mostly in Manhattan, were occupied and had allocated 20 percent of their apartments (approximately 4,500 units) to low-income tenants. The credits can be syndicated to generate equity for the project. Available on NYC Housing Connect are a mix of studios, one-, two-, and three-bedroom units for residents at 50 to 60 percent of the area median income, ranging in eligible income from 26,023 to 84,600. The tax-exempt bond financing generates four-percent as-of-right Low-income Housing Tax Credits (LIHTC) for the units occupied by very low-income households. The remaining units can be rented at market rate. For low income, victims of domestic violence there are special guidelines. The very low-income requirement is usually outlined in a Regulatory Agreement that dictates that the maximum rent on these affordable units cannot exceed 30 percent of the applicable income limits. Click here to read more about income requirements in the NYC Housing Connect. Builders & Contractors Buildings Information System (BIS), permits, licenses, inspections, Plan Examiner, safety. Twenty percent of a project’s units must remain affordable to very low-income households for a given time period agreed upon between HFA and the building owner. Housing lotteries, New York City Housing Authority (NYCHA) public housing, Mitchell-Lama, ownership, homeless shelters. Alternatively, 25 percent or more of a project’s units must be affordable to households whose income is up to 60 percent of the AMI, adjusted for family size.

At least 20 percent of the units must be set aside for households with incomes of up to 50 percent of the local Area Median Income (AMI), adjusted for family size. In the 80/20 Program, the Housing Finance Agency (HFA) offers tax-exempt financing to multi-family rental developments in which at least 20 percent of the units are set aside for very low-income residents, using funds raised through the sale of bonds.

0 kommentar(er)

0 kommentar(er)